Currently, many businesses have received messages and calls from individuals claiming to be employees of the Tax Office asking businesses to provide business licenses, business registration certificates or request to download tax-related applications through a link. The target audience of these impostors is small and medium enterprises, production and business establishments, most of which are newly established enterprises that do not have a solid legal team. These impostors call directly to the phone number registered for business establishment.

1. Actual situation

From the beginning of 2023 until now, some businesses have received a number of calls from individuals claiming to be tax authorities calling to instruct them on certain procedures or inform them that they need to add certain documents or procedures, but the truth is that it is not the tax authorities contacting but the impostors who are communicating with the business.

The common feature of these subjects is that calls often take place very quickly and do not give businesses the opportunity to ask for information or ask their questions, as well as cannot be contacted again because the phone number is always busy, some subjects also make zalo friends (zalo has a clear close-up background to increase trust) with legal representative, the accountant, or authorized person of the business to send the link and “instructions” to download the tax-related application to the phone.

Some recent cases have been recorded from businesses:

Phone calls announcing that the enterprise lacks business licenses for conditional business lines:

Businesses received phone calls from some people claiming to be employees of the tax department. This subject shows a very thorough grasp of the business and clearly reads information such as business name; name, citizen identification, other information of the legal representative, business address, contact phone number of the legal representative of the enterprise,… and asks listeners to confirm. After that, this person will report that the current enterprise is lacking business licenses for conditional business lines and request to additional tax authorities then quickly hang up, whether the business is fully licensed or does not have a conditional business line.

We can’t say for sure what the purpose of these scams is, but some business owners confirming personal information over the phone may result in personal information being stolen. In addition, the false information provided by these subjects causes confusion for the management and operation of the enterprise and discredits the tax authorities.

Phone calls requesting the installation of applications impersonating state agencies or applications of unknown origin:

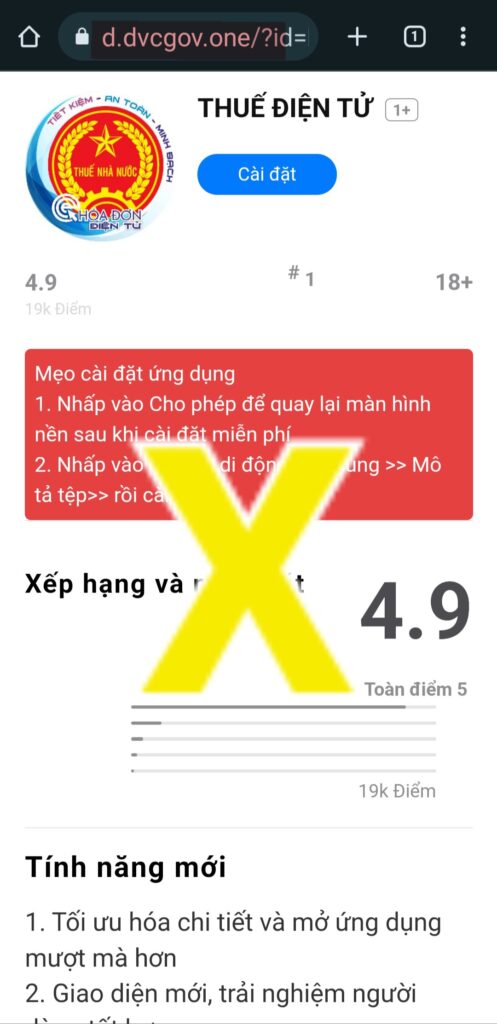

According to a familiar motif, subjects still impersonate employees of tax authorities to contact businesses, who will request the installation of an application called “Thue dien tu” through an access link impersonating the public service portal to conduct tax registration. One of the fake links encountered by our customers is “dvcgov.one“.

The subject will ask to fill in the personal information of the legal representative of the enterprise, thereby stealing personal data information and illegally profiting, to build trust, the scammer will ask for zalo friends as a form of contact to answer questions.

In fact, noting that these impersonation applications once downloaded to the phone will be difficult to remove and must require the assistance of technicians. The longer these apps stay on the phone, the greater the risk of personal data theft, so business owners need to be very careful and careful.

2. Prevention and recognition measures:

In fact, if employees working at the Tax Office want to contact citizens, they will always announce their name, position, belonging to the tax inspection team and call from the Tax Department in any district so that people can accurately identify the individual from the other end of the line who is an employee of the State Agency contacting to work.

In case the subject has not been fully identified, enterprises need to ask clearly who the subject is, from which tax authority, which department belongs to ensure full information. And especially, experts of the tax department will never hang up immediately without letting businesses present questions.

Tax authorities will conduct tax registration for businesses when businesses submit documents directly and completely, not requiring businesses to perform operations through the application and absolutely never send strange access paths to businesses.

Identification signs for businesses to prevent fraudsters from compromising personal information:

√ Receiving a call claiming to be an employee of the Tax Office but not providing information and speaking unclearly, hurriedly hung up the phone;

√ When businesses contact the target again, the phone numbers are always busy and do not pick up the phone;

√ Once unfamiliar applications have been installed and cannot be uninstalled.

Safety measures for businesses to protect themselves and avoid:

→ Businesses should not accept friend requests from suspects of impersonation;

→ Do not access strange links when sent by this person;

→ Do not install applications that are not verified using the path sent by objects. Because applications of state agencies can only be downloaded through CH PLAY or APPSTORE to be verified.

→ The best self-protection measure is that businesses must quickly contact and meet directly with experts of the corporate tax administration authority to verify information and absolutely not follow the instructions of suspected fraudsters;

→ When you have accidentally installed strange applications and cannot be removed, you should quickly see a technician to remove the application as quickly as possible;

→ Report to the police when personal information, property and personal data have been violated.

In order to protect personal information and of the whole business from being infringed by impersonators, enterprises need to be very careful and must report to competent state agencies immediately when there is a suspicion or detection of violators.